Your Guide to SaaS Metrics Benchmarks

SaaS metrics benchmarks are simply the average performance data for the industry. They're what other successful companies look like, giving you a yardstick to measure your own business against. Think of them less as rigid rules and more as a helpful reality check to see if your growth, churn, and efficiency are on the right track.

This context is what turns a spreadsheet full of numbers into a genuine strategic asset.

Why SaaS Benchmarks Are Your Growth Compass

Imagine you're driving on the highway without a speedometer. You feel the speed, you see the scenery whizzing by, but you have no idea if you're keeping pace with traffic, lagging behind, or about to get a ticket. That’s what running a SaaS company without benchmarks is like.

Your internal metrics are the same way. Let's say your monthly customer churn is 2%. Is that good or bad? On its own, it’s just a number. But when you hold it up against an industry benchmark, the picture becomes a lot clearer. If similar companies average 5% churn, your 2% is fantastic. But if the benchmark is 0.5%, that 2% suddenly looks like a flashing red light on your dashboard, signaling a major retention problem.

Turning Data Into Direction

Benchmarks give your numbers meaning. They transform isolated data points into a clear roadmap, helping you answer the tough questions that actually drive your strategy:

- Are we really growing fast enough? Your Annual Recurring Revenue (ARR) growth might feel good, but comparing it to benchmarks for your stage tells you if you're leading the pack or falling behind.

- Is our customer acquisition model working? The LTV to CAC ratio is the classic metric here. Benchmarks show whether your spending is smart and profitable or if you're overpaying for growth.

- Are we keeping customers happy? Stacking your churn rate and Net Promoter Score (NPS) against the competition is the fastest way to gauge customer loyalty.

This kind of comparative insight is make-or-break in the SaaS world. With the global market projected to hit $793.1 billion by 2029, you're not just competing on features—you're competing on performance. Knowing exactly where you stand isn't just nice to have; it's essential. You can dig deeper into these market trends and their impact to understand the competitive pressures at play.

By consistently measuring your performance against SaaS metrics benchmarks, you stop guessing and start knowing. You can set smarter goals, spot weaknesses before they snowball, and pour your resources into the areas that will actually move the needle.

In other words, benchmarks are your guide to building a business that lasts. They make sure you’re not just busy, but busy doing the right things to win.

Before we dive deep into each metric, here's a quick overview of the core benchmarks we'll be covering. This table is a handy reference for understanding what each one measures and why it's so critical for gauging the health of a SaaS business.

Core SaaS Metrics at a Glance

| Metric | What It Measures | Why It's a Benchmark |

|---|---|---|

| Annual Recurring Revenue (ARR) | Predictable revenue a company expects in a year. | The primary indicator of a SaaS company's scale, growth trajectory, and overall health. |

| Customer Churn | The rate at which customers cancel their subscriptions. | A direct measure of customer satisfaction and product-market fit. High churn is a major red flag. |

| LTV to CAC Ratio | The lifetime value of a customer versus the cost to acquire them. | The fundamental measure of the long-term profitability and sustainability of a company's business model. |

| Net Revenue Retention (NRR) | Revenue from existing customers, including upsells and churn. | Shows if a company can grow even without acquiring new customers. It's a key sign of a "sticky" product. |

| SaaS Magic Number | The efficiency of sales and marketing spend in generating new revenue. | A clear indicator of whether it's time to invest more heavily in growth or focus on efficiency. |

This snapshot gives you a great starting point. Now, let's get into the nitty-gritty of each one, exploring the numbers, what they mean at different stages, and how you can use them to build a stronger business.

Decoding Your ARR Growth Benchmarks

Of all the numbers you track, Annual Recurring Revenue (ARR) is the true pulse of your SaaS business. It’s the predictable revenue you can count on from your subscribers over the next year. More than anything else, your ARR growth rate tells the story of your company's health, momentum, and future potential.

But here’s the catch: a “good” growth rate isn’t a one-size-fits-all number. What’s considered fantastic for a mature, established player would be a red flag for an early-stage startup. Understanding the right saas metrics benchmarks for ARR growth really comes down to one thing: your current size.

Early Stage Benchmarks: Under $1M ARR

When you're just getting off the ground, the game is all about speed. For SaaS companies with less than $1 million in ARR, the expectation is to double or even triple your size every single year. A growth rate of 100% or more isn't just a stretch goal; for many venture-backed startups, it's the baseline.

This explosive growth is what happens when you nail your product-market fit and start firing up your first go-to-market engine. Each new customer adds a massive percentage bump to your revenue, making those triple-digit growth figures feel within reach. If you need a refresher on the basics, you can learn more about what ARR is and how to calculate it in our detailed guide.

Growth Stage Benchmarks: $1M to $10M ARR

Once your business starts to mature, the law of large numbers inevitably kicks in. It's just plain harder to double your revenue when you're starting from a bigger base. For companies pulling in between $1 million to $10 million in ARR, growth rates naturally start to level off.

At this stage, a healthy, strong growth rate lands somewhere in the 40% to 60% range. If you’re beating that, you’re in the top tier of performers. The focus also starts to shift from just signing new logos to a more balanced strategy that pulls in expansion revenue from existing customers and gets smarter about operational efficiency.

A popular framework for ambitious SaaS companies is the "T2D3" model (triple, triple, double, double, double). The idea is to triple your ARR for two years straight, then double it for the next three years to rocket past the coveted $100M ARR mark.

Scale-Up Stage Benchmarks: Over $10M ARR

Crossing the $10 million ARR line means you've officially made it to the scale-up league. Growth at this level is less about raw speed and more about building a sustainable, efficient expansion machine. The days of doubling every year might be behind you, but you still need to post impressive numbers.

For companies in this bracket, a year-over-year growth rate between 25% and 40% is considered excellent. Keeping up that kind of pace requires a well-oiled machine where sales, marketing, product, and customer success are all working in perfect sync.

What Shapes Your Growth Potential?

It’s crucial to remember that these benchmarks aren't concrete rules. They’re guideposts. Several factors will absolutely influence what a "good" growth rate looks like for your specific business.

- Market Size: Are you playing in a vast, open ocean or a small, crowded pond? A company with a massive Total Addressable Market (TAM) simply has more room to run than one in a saturated niche.

- Funding Model: Venture-backed companies are often expected to pour fuel on the fire, spending aggressively on sales and marketing to chase higher growth rates than their bootstrapped peers. In fact, data shows they often spend nearly double on sales.

- Pricing Strategy: Your Average Revenue Per Account (ARPA) matters—a lot. A company selling high-ticket enterprise contracts can grow revenue much faster with fewer new logos than a business built on a high-volume, low-price product.

At the end of the day, these saas metrics benchmarks give you a critical frame of reference. Use them to set goals that are ambitious but grounded in reality, check the health of your growth engine, and make smarter decisions that will set your company up for a long, successful future.

Winning the Battle Against Customer Churn

If Annual Recurring Revenue (ARR) is the pulse of your SaaS business, then customer churn is the slow leak that can silently sink the ship. It’s the rate at which you lose customers, and if you let it run unchecked, it will undermine even your most impressive growth wins. Knowing the industry saas metrics benchmarks for churn is fundamental to building a company that lasts.

But here’s the thing: not all churn is created equal. You have to look past the raw number of customers you lose and really zero in on the revenue that walks out the door with them.

Customer Churn vs. Revenue Churn

Think about it this way: losing two small startups paying $50/month is a completely different problem than losing one enterprise client paying $5,000/month. In the second scenario, your customer churn is technically lower (you only lost one logo), but the financial punch is way more severe.

This is why we split the metric in two:

- Customer Churn: This is the percentage of customers who cancel their subscriptions in a given period. It tells you about the volume of people leaving.

- Revenue Churn: This is the percentage of recurring revenue you lose from those cancellations. It shows you the actual financial impact of those departures.

Most experienced SaaS operators live and die by revenue churn. It paints a much clearer picture of your company's financial health and the real-world sting of lost business.

Churn Benchmarks by Customer Segment

Just like with ARR growth, what’s considered an “acceptable” churn rate depends entirely on who you’re selling to. The expectations for a high-volume, low-cost product are worlds apart from a high-touch enterprise solution.

Good to Great Monthly Churn Rates

- SMB Focus: 3% – 5% monthly churn is generally acceptable. Dropping below 3% is where you start to look really strong.

- Mid-Market Focus: You're aiming for a 1% – 2% monthly churn rate.

- Enterprise Focus: Less than 1% monthly churn is the gold standard here.

Companies that serve small and medium-sized businesses (SMBs) will almost always have higher churn. Their customers are more sensitive to price, and frankly, more of them go out of business. On the flip side, enterprise clients have much higher switching costs, which makes them stickier and keeps their churn rates incredibly low.

The Ultimate Goal: Negative Churn

The holy grail for any SaaS business is achieving negative churn. This is the magic moment when the extra money you make from your existing customers—through upgrades, add-ons, or expanded usage—is more than the revenue you lose from cancellations.

When you hit negative churn, your company grows even if you don't sign a single new customer. It’s a powerful sign that your product is sticky, your customer relationships are solid, and you have a clear path for expansion. Your customer base literally becomes its own growth engine. Understanding the mechanics is the first step, and our guide on how to actively reduce your churn rate offers strategies you can put into practice right away.

The numbers don't lie. While average annual churn rates for SaaS companies are often between 5% and 7%, smaller businesses can see churn as high as 20%. The upside of improving this is massive; a small 5% reduction in churn can boost profits by up to 95%. This is why renewals get the lion's share of SaaS budgets, with about 85% of spending going toward existing licenses, as noted in some SaaS retention statistics on zylo.com.

To fix churn, you have to diagnose why customers are leaving in the first place. By tracking both customer and revenue churn against these benchmarks, you can see where you’re losing ground and take decisive action to keep your hard-won customers happy, engaged, and paying.

Measuring Your Growth Efficiency with LTV to CAC

So, you know how fast you're growing (ARR growth) and whether customers are sticking around (churn). But there's a third, absolutely critical question: is that growth actually profitable?

That's where the Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio comes into play. Think of it as the ultimate health check for your growth engine. It’s easily one of the most important saas metrics benchmarks you can track.

Put simply, for every dollar you spend on sales and marketing to land a new customer, how many dollars will they bring back to your business over their entire lifetime? The LTV to CAC ratio answers that question with a single, powerful number.

What Your LTV to CAC Ratio Is Telling You

This isn't just some abstract number for a spreadsheet. It's a direct signal about the health and sustainability of your business model. Different ratios tell very different stories.

Here’s a quick way to read the signals:

- A 1:1 Ratio: This is a serious warning sign. You're spending a dollar to make a dollar back. When you add the costs of actually serving that customer, you're officially losing money on every new deal.

- A 3:1 Ratio: This is what most in the industry consider the sweet spot. For every dollar you spend, you get three back. It's a clear sign of a healthy, profitable, and sustainable growth model.

- A 5:1 Ratio or Higher: Looks amazing, right? But be careful. A ratio this high might mean you’re being too conservative and underinvesting in growth. You could be leaving money on the table by not spending more to capture the market faster.

Getting this ratio right is fundamental. If you want to dive deeper into the nuts and bolts, our guide on how to master your lifetime value calculation for SaaS breaks down all the formulas you'll need.

The LTV to CAC ratio gives you a direct line of sight into the long-term profitability of your customer acquisition strategy. A healthy ratio proves your business isn't just growing—it's growing in a way that creates real value.

Understanding the CAC Payback Period

Tied at the hip with LTV to CAC is another vital metric: the CAC Payback Period. This one is all about speed. It tells you exactly how many months it takes to earn back the initial cost of acquiring a customer.

For example, if your CAC is $6,000 and that customer pays you $500 a month, your payback period is 12 months. Simple as that.

This is a huge deal for your cash flow. The faster you get your money back, the faster you can pour it back into acquiring the next batch of customers. For most SaaS companies, a payback period of under 12 months is the goal. Hitting that mark is a sign of a seriously efficient growth machine.

SaaS Benchmarks by Company Stage and Model

Benchmarks aren't one-size-fits-all. A startup hunting for its first 100 customers will have a very different financial profile than a public company. The table below provides a general look at how key metrics can vary depending on a company's size and who they sell to.

| Metric | Early Stage (<$5M ARR) | Growth Stage ($5M – $50M ARR) | Enterprise Focus |

|---|---|---|---|

| ARR Growth | 100%+ (Triple, triple, double, double, double) | 50% – 100% | 20% – 40% (more predictable) |

| Net Churn | 0% – 2% monthly (high gross, offset by expansion) | -2% to 1% monthly (negative churn is the goal) | <5% annually (high stickiness) |

| LTV / CAC | 1 – 3x (still finding efficiency) | 3 – 5x (optimized growth engine) | 5x+ (high LTV, longer sales cycles) |

These figures show how expectations shift as a business matures. Early on, explosive growth is key, even if efficiency isn't perfect. But as you scale, investors expect to see a healthy, proven economic model with strong LTV/CAC and low churn.

LTV to CAC and the CAC Payback Period aren't just for your finance team. Together, they give you a complete picture of your growth efficiency. They tell you if you're building a business that can last, not just one that's growing for growth's sake. These numbers should guide everything from your marketing budget to your pricing strategy.

How to Build Your SaaS Metrics Dashboard

Knowing the industry benchmarks for SaaS metrics is a great start, but the real magic happens when you turn that knowledge into action. Data sitting in a spreadsheet doesn't do much. You need a focused, easy-to-read dashboard that tells you the story of your business in a single glance.

Think of a good dashboard as your company’s command center. It cuts through all the noise and puts a spotlight on the vital signs, making sure you and your team are always dialed in on the numbers that truly move the needle. The goal is to build a single source of truth that shapes both your weekly moves and your long-term strategy.

Ditching Vanity Metrics for Actionable Insights

The very first step is to be brutally honest about what you track. It's incredibly easy to get sidetracked by "vanity metrics"—those numbers like total sign-ups or social media followers that feel good but don’t actually say much about the health of your business. They're nice to look at, but they won't help you make smarter decisions.

Instead, your dashboard needs to zero in on the core benchmarks we’ve been talking about. These are the metrics that directly measure the strength and momentum of your business model, giving you a clear, unfiltered picture of how you stack up.

A great SaaS dashboard isn't about tracking everything. It’s about tracking the right things with relentless consistency. It should answer one simple question: "Are we building a healthy, sustainable business?"

By focusing on just a handful of powerful metrics, you create incredible clarity. Everyone, from the CEO down to a new marketing hire, can instantly see what success looks like and how their work fits into the bigger picture. We explore this concept in more detail in our guide to creating effective business scorecards and dashboards.

Your Essential SaaS Dashboard Template

When you're just getting started, keep it simple. A straightforward weekly or monthly dashboard that covers the four pillars of SaaS health is more than enough—in fact, it’s incredibly powerful. This approach ensures you’re keeping a balanced eye on growth, retention, and efficiency.

Here are the four key areas your first dashboard should cover, along with the questions they help answer:

-

Growth Momentum: How fast is our predictable revenue actually growing?

- Metric to Track: Annual Recurring Revenue (ARR) Growth Rate (both year-over-year and month-over-month)

-

Customer Retention: Are customers sticking with us and getting value?

- Metric to Track: Net Revenue Retention (NRR) and Revenue Churn Rate

-

Acquisition Efficiency: Is our growth engine actually profitable?

- Metric to Track: LTV to CAC Ratio

-

Cash Efficiency: How long does it take to make back what we spent to get a customer?

- Metric to Track: CAC Payback Period (in months)

Using Benchmarks to Set Internal Goals

This is where your dashboard goes from being a report to a strategic weapon. Next to each of your core metrics, add the industry benchmark for a company at your stage.

Suddenly, your numbers have context. For example, seeing that your LTV to CAC ratio is 2.5:1 might seem okay on its own. But when you place it next to the industry benchmark of 3:1, you instantly have a clear, measurable goal. Now you can rally your marketing and sales teams around specific initiatives to close that gap.

This simple act of tracking your metrics and comparing them to external standards fosters a culture of continuous improvement. It gives you the clarity to set ambitious yet realistic goals, spot problems before they spiral, and get your entire company aligned on what success truly looks like.

Using Benchmarks to Make Smarter Decisions

Knowing your numbers is one thing, but actually using them to steer the ship is a whole different ballgame. SaaS benchmarks aren't just for vanity reports—they're powerful diagnostic tools. Think of them as guideposts that show you where your business is crushing it and, more importantly, where it needs some serious attention.

It’s a bit like a doctor looking at your lab results. A number that’s out of the normal range isn’t a personal failing; it’s simply a signal to dig deeper and figure out what’s going on. The same logic applies to your SaaS company.

Translating Benchmarks into Actionable Strategy

When one of your key metrics is falling short of the benchmark, it immediately points you toward a specific set of questions. This is where the real work—and real progress—happens. You start turning abstract data into a concrete plan for getting better.

Let’s walk through a couple of common scenarios to see how this plays out.

-

Scenario 1: Your LTV/CAC Ratio is 2:1

- The Problem: You're basically spending too much to acquire customers compared to what they're worth over time. The healthy benchmark is 3:1, so your growth engine is running inefficiently.

- Levers to Pull: Is your pricing too low? Could you tighten up your sales process to close deals faster? Maybe it's time to shift marketing dollars from high-cost channels to more cost-effective ones like content or referrals.

-

Scenario 2: Monthly Churn is 6%

- The Problem: If you're selling to SMBs, your churn is well above the acceptable 3-5% benchmark. Your bucket is leaking, and it’s costing you.

- Levers to Pull: Is your onboarding process a dud, failing to get users to that "aha!" moment? Are you missing a key feature that competitors have? Or is your customer support team dropping the ball?

Benchmarks don't give you the answers, but they tell you exactly where to start looking for them. They turn a vague feeling of "we need to do better" into a focused mission to solve a specific, measurable problem.

Building a Roadmap for Growth

By consistently checking your performance against SaaS metrics benchmarks, you create a continuous feedback loop for your business. This process helps you prioritize what actually matters, ensuring you're not wasting energy fixing things that are already working fine.

Instead, you can pour your resources into the areas that will have the biggest impact.

Suddenly, your metrics are more than just numbers on a dashboard; they become the very foundation of your growth strategy. Use them to set realistic goals, keep your teams accountable, and build a resilient SaaS company that's truly built to last.

Common Questions About SaaS Benchmarks

Even after you've got a handle on the core metrics, the real questions start popping up when you try to apply saas metrics benchmarks to your own business. Let's tackle some of the most common ones I hear from founders.

Think of this as your field guide for putting benchmarks to work. We'll get into the "how" and "when" that naturally follow the "what" and "why," so you can use these industry standards to your advantage without getting lost in the data.

How Often Should I Review My Benchmarks?

The right rhythm for checking your metrics really depends on what you're measuring and how mature your company is. You don't need to stare at every single number every day—in fact, that's a great way to make panicked, short-sighted decisions. A more thoughtful schedule works much better.

Here’s a simple cadence that most SaaS companies can start with:

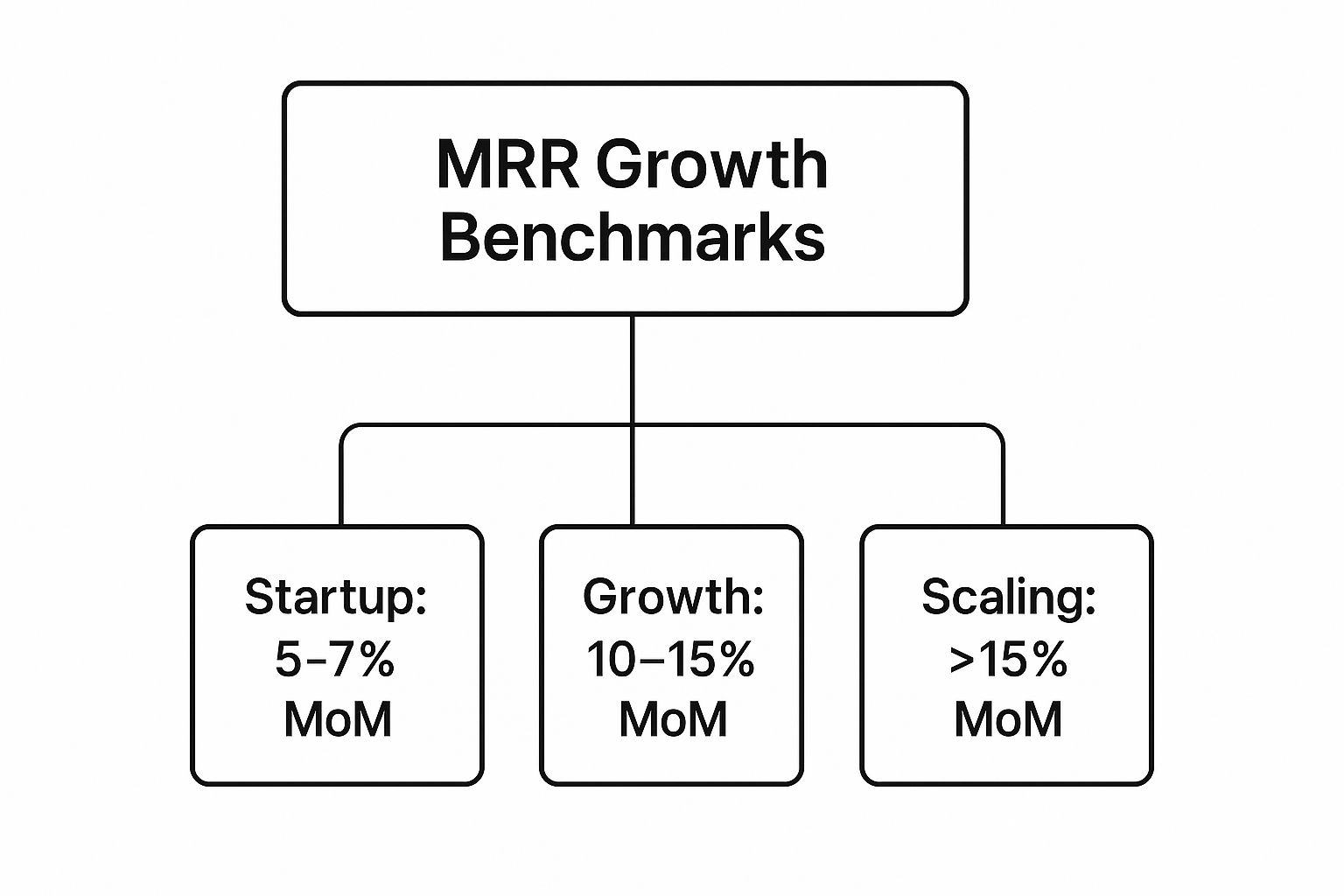

- Daily or Weekly: Keep a close eye on your leading indicators like new trial sign-ups and Monthly Recurring Revenue (MRR). These numbers are the immediate pulse of your business.

- Monthly: This is the perfect frequency for tracking churn (both customer and revenue) and Net Revenue Retention (NRR). It's often enough to spot trends before they become major problems but not so often that you overreact to a random blip.

- Quarterly: Look at your big-picture efficiency metrics like LTV/CAC and CAC Payback Period. These need a larger dataset to tell a meaningful story and are best reviewed when you're thinking more strategically about the long term.

What Is the Difference Between a Benchmark and a KPI?

This is a mix-up I see all the time, but the difference is critical for setting goals that actually move the needle. They're related, but they do two very different jobs.

A Key Performance Indicator (KPI) is an internal goal—a target you set for your own team. For example, "We're aiming to get our monthly revenue churn below 1% by the end of Q3." It's specific to your business and what you're trying to achieve right now. You can dive deeper into a full list of SaaS KPIs in our comprehensive guide.

A benchmark, however, is an external standard. It tells you what "good" looks like based on what other, similar companies are achieving. For instance, "The industry benchmark for churn in our vertical is 1.5%."

You use benchmarks to sanity-check your goals and set ambitious yet realistic KPIs. The benchmark shows you where you stand in the market, while the KPI tracks your progress toward a target you've set for yourself.

What Should I Do if My Metrics Are Low?

First things first: don't panic. A metric that's lagging behind the benchmark isn't a failure—it's a bright, flashing sign telling you where to dig in. Instead of jumping to conclusions, work through the problem logically.

Start by double-checking your math. Is the data clean? Are the calculations correct? Once you've confirmed the numbers, you can get to the interesting part: figuring out the "why." If your churn is high, get on the phone with customers who recently left. If your CAC is climbing, break down the performance of every single marketing channel.

Focus your energy on the one metric that will create the biggest positive ripple effect across the business. For most early-stage companies, that's almost always churn.

At SaaS Operations, we provide proven playbooks and templates to help you measure what matters and build a more efficient business. Our frameworks are designed by operators who have scaled multiple 8-figure SaaS companies. Get the tools to accelerate your growth today.

Swipe & Deploy Playbooks

Stop running in mud and get your team ahead today. Discover actionable playbooks you can use instantly.

Create Playbooks- ✓ Step-by-step guides

- ✓ Proven templates

- ✓ Team checklists