Fighting churn isn’t about plugging leaks after the fact; it’s about building a boat that doesn’t leak in the first place. Too many operators get stuck in a reactive loop, only paying attention to churn when it’s too late. But the truth is, what looks like a small monthly percentage quickly snowballs into a massive revenue problem, making retention your most powerful growth engine.

After all, keeping a customer you already have is always cheaper and more effective than chasing a new one.

The Hidden Costs of Customer Churn

Churn is so much more than a number on a dashboard. It’s a silent killer of growth potential. While most SaaS leaders track it, many don’t truly appreciate its compounding damage. It’s all too easy to shrug off a few lost customers each month, but that mindset completely misses the destructive snowball effect.

Let’s put it into perspective. Say your SaaS company has a 5% monthly churn rate. Doesn’t sound too scary, right? But that seemingly small number is quietly eating away at your business month after month.

The Compounding Effect of Monthly Churn

That 5% monthly churn isn’t a simple loss. It compounds. Over the course of a year, that rate means you’ve waved goodbye to nearly half of your original customer base. This creates a constant “leaky bucket” problem where your sales team is running on a treadmill, working hard just to stand still.

Think about it—all the money and effort you poured into marketing, sales, and onboarding for those lost accounts? Gone. This constant churn hamstrings your acquisition efforts and can make your company look far less attractive to potential investors.

Customer churn isn’t just about losing that one subscription fee. It’s about losing all the future revenue, the potential referrals, and the invaluable feedback that customer would have brought to the table.

In the cutthroat SaaS market, treading water isn’t the goal—growth is. A healthy annual churn rate for a growing company should be well below 5%. That 5% monthly churn we talked about? It adds up to an annual loss of around 46% of your customers. That’s a devastating hit to your bottom line. You can explore more about how these numbers affect valuations by digging into data-driven strategies to reduce customer churn.

The Shift to a Proactive Retention Strategy

Once you grasp these hidden costs, your entire perspective has to change. Suddenly, reducing churn isn’t just damage control—it’s one of the smartest growth strategies you can deploy. The focus has to shift from reactive moves, like sending last-ditch exit surveys, to proactive systems that spot at-risk customers before they even think about leaving.

This proactive mindset is the foundation of our proven SaaS playbooks, which give you the frameworks to build durable retention systems from the ground up. By keeping an eye on leading indicators—things like a drop-off in product usage or a sudden spike in support tickets—you can step in early to remind customers of your value and get them back on track.

The ultimate goal is to build a business where customer retention is part of the company’s DNA. It’s about creating a culture where every single team, from product to sales, is obsessed with delivering an experience so good that customers wouldn’t dream of leaving. That’s how you build real, long-term, sustainable growth.

Build Your Proactive Retention Framework

Alright, let’s get down to business. Talking about churn is one thing; actually stopping it is another. The real work begins when you build a proactive system that’s obsessed with delivering value to your customers. This isn’t just a “Customer Success” problem—it’s an all-hands-on-deck effort.

First things first: break down the silos. You need to assemble a cross-functional team that truly owns retention. Think of it as your retention-fighting squad. This group should absolutely include leaders from:

- Customer Success: They’re in the trenches every day. They know what customers love and what drives them crazy.

- Product: These are the builders. They need to hear firsthand which features create sticky customers and where people are getting stuck.

- Sales: They set the initial expectations. Their insights on why a customer signed up in the first place are pure gold.

When these teams work together, you stop treating churn like a random fire you have to put out. Instead, it becomes a shared, predictable problem you can solve systematically.

Define What Churn Means to You

Before you can fix churn, you have to agree on what it actually is. It sounds obvious, but I’ve seen so many companies get this wrong.

Is churn just a canceled subscription? What about a big customer downgrading from your top-tier enterprise plan to a basic one? That’s a huge hit to your monthly recurring revenue (MRR), and you absolutely need to track it as a form of churn.

So, get specific. Create crystal-clear definitions for both logo churn (losing a customer) and revenue churn (losing revenue). The difference is critical. Losing ten small accounts might sting less than losing one major enterprise client that takes a massive chunk of revenue with them.

Once you’ve defined it, you can start hunting for the breadcrumbs customers leave behind before they walk away.

Identify Early Warning Signs

The best way to fight churn is to see it coming. You need to build a “churn radar” by spotting the leading indicators—the subtle signals that an account is at risk before they hit the cancel button.

This gives your team a crucial window to step in and turn things around.

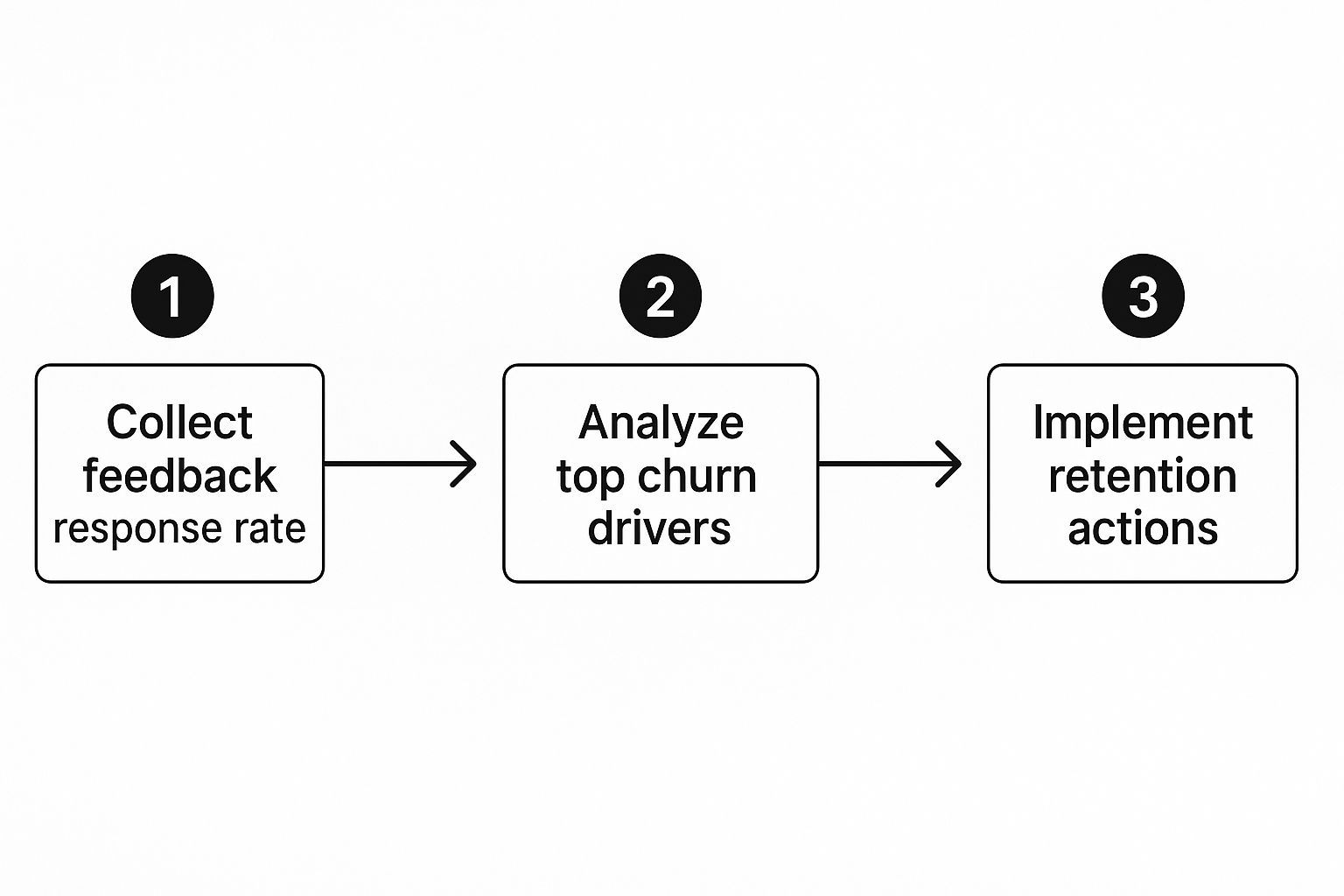

This is about creating a feedback loop: collect data, figure out what’s driving the behavior, and take targeted action.

So, what should you be looking for? Dig into your data. From my experience, a few signals are almost always red flags. To help you get started, here’s a breakdown of common indicators and what you should do about them.

Key Churn Indicators and What They Mean

| Indicator | What It Signals | Proactive Action to Take |

|---|---|---|

| Declining Product Usage | The customer is no longer seeing value or has found an alternative. This is a very strong churn predictor. | Have their CSM reach out with a “health check” email offering a strategy call or a new feature training. |

| Spike in Support Tickets | The user is frustrated, hitting roadblocks, or experiencing bugs. Their experience is poor. | Flag the account for a product specialist to review their case history and identify underlying issues. |

| Late Payments | While sometimes just an admin error, frequent late payments can mean your tool is no longer a priority. | Trigger an automated, friendly reminder, but if it persists, have an account manager follow up personally. |

| Champion Leaves the Company | The internal advocate who bought your tool is gone. Without them, the renewal is at serious risk. | Immediately reach out to build a relationship with the new point of contact and re-establish your value. |

The key is to act on these signals, not just observe them. A dip in usage should trigger an outreach email from a CSM offering a “health check” call. A spike in tickets should flag the account for a product specialist to review their case history.

For a deeper dive into building out this framework, there are some excellent proven strategies to reduce customer churn that can give you more ideas.

Create a Customer Health Score

Now, how do you turn all these different signals into something you can act on quickly? You create a customer health score.

Don’t overcomplicate this at the start. You don’t need a fancy algorithm. Begin with a simple, weighted scorecard that pulls together a few of these key metrics.

For example, you could assign points based on product usage, payment history, and support ticket volume. A customer with high engagement and on-time payments might score a 95/100 (Healthy). Another account with falling usage and several angry support tickets might be a 45/100 (At-Risk).

This simple system gives your team an at-a-glance way to prioritize their day. They can immediately see who needs help and focus their energy where it will make the biggest impact.

Using Automation for Early Intervention

As you scale, you simply can’t keep an eye on every customer signal manually. It’s a losing battle. This is where you bring in the machines. Automation is your best friend in the fight against churn, giving you the power to scale your retention efforts and step in with precision long before a customer thinks about leaving.

By plugging into your customer analytics, you can set up simple workflows that sniff out churn signals 60 to 90 days in advance. The goal isn’t just reacting faster. It’s about building a proactive engine that runs 24/7, flagging risks so your team can focus on what they do best: building relationships, not frantically putting out fires.

This all starts when you turn your customer health score from a passive metric on a dashboard into an active trigger. When a score dips below a certain point, it should kick off a whole sequence of events designed to win that user back.

Segmenting for Scalable Outreach

First things first, you need to segment your customers into clear, actionable tiers. This is non-negotiable. Grouping them by health score and other key data points lets you apply the right amount of pressure in the right places.

A simple, effective model I’ve seen work time and again looks like this:

- Healthy (80-100): These are your champions. They’re engaged, happy, and prime candidates for case studies and referrals. The goal here is simple: keep them happy.

- At-Risk (50-79): These accounts are waving yellow flags. Maybe logins are down, they aren’t using key features, or they just had a rough support experience. They need a gentle, helpful nudge.

- Critical (Below 50): Red alert. These customers are actively pulling away and are very likely to churn soon. They need immediate, high-touch intervention from a human.

Without this segmentation, you’re flying blind. You end up treating everyone the same, wasting valuable time on healthy accounts while your critical ones slip away unnoticed.

Building Your Automated Playbooks

Once your segments are defined, it’s time to build the automated playbooks that trigger specific actions. These aren’t generic email blasts. We’re talking about targeted, context-aware interventions that get to the heart of why a customer is at risk.

The best automation feels personal and helpful, not robotic. The system’s job is to spot the problem and cue up the right human-to-human interaction at the perfect moment.

Think of it as creating a series of “if this, then that” recipes for customer retention. For example, if a customer’s health score falls into the ‘At-Risk’ category, a workflow can immediately send them an email. Maybe it offers a free spot in a training webinar that highlights a feature they aren’t using. It’s timely, it’s relevant, and it adds value without your team lifting a finger. If you want to dive deeper, you can learn more about how to set up these kinds of systems in our guide to marketing automation for SaaS.

For a ‘Critical’ account, the stakes are much higher, and your automation needs to reflect that urgency. Forget the email. Instead, the workflow could automatically create a high-priority task in your CRM and assign it directly to the right Customer Success Manager (CSM).

The task should be packed with context, like “Usage dropped 40% in 30 days,” and have a crystal-clear next step: “Schedule a personal call within 24 hours.”

An Example Workflow in Action

Let’s walk through what this looks like in the real world. Imagine a customer, “Innovate Corp,” has been a solid user for six months. But then your system spots that their lead admin hasn’t logged in for three weeks.

Here’s the chain of events:

- The Trigger: The system flags this inactivity. Innovate Corp’s health score drops from a healthy 85 to 65, pushing them into the ‘At-Risk’ segment.

- The Automated Action: An automated workflow instantly sends an email to that admin. The subject line is friendly and low-pressure: “A few new tricks for your Innovate Corp dashboard.” The email body cleverly highlights a new feature that solves a common problem.

- The Human Follow-Up: If the admin doesn’t engage with the email in three days, the system escalates. It creates a task for their CSM with a simple note: “Innovate Corp is disengaging. Follow up with a personal check-in.”

This simple, automated sequence is a safety net. It ensures that no at-risk customer ever slips through the cracks. It starts with a low-touch, helpful nudge and only brings in a human when it’s truly necessary, allowing your team to manage more accounts effectively and focus their energy where it counts most.

Mastering Customer Onboarding and Engagement

More often than you’d think, high churn rates can be traced right back to a messy start. Those first 90 days are everything. It’s the window where your new customers either have that “aha!” moment and see your product’s value, or they get frustrated and quietly start looking for the door.

If you want to get a handle on churn, you absolutely have to nail this initial experience.

The real goal here is to help users get to their first win as fast as humanly possible. This is that magic moment when they use your tool to solve a real, nagging problem for the first time. A well-thought-out, structured onboarding process is your roadmap to delivering that critical first victory.

Crafting the Perfect First Impression

Your onboarding can’t feel like a generic, one-size-fits-all lecture. It needs to be a guided, supportive experience that builds both confidence and momentum from day one.

A great place to start is with in-app guided tours. And I don’t mean the lazy pop-ups that just point to buttons. A truly effective tour is built around a single, high-value outcome.

For instance, instead of a tour that says, “This is where you create reports,” reframe it to be task-oriented: “Let’s build your first sales performance report in 60 seconds.”

That small tweak in language changes everything. It shifts the user from passively learning to actively doing. It’s the difference between showing someone a kitchen and actually helping them bake their first cake.

The Welcome Email Series That Actually Works

Your welcome email sequence is another powerful lever for driving that initial engagement. Please, avoid the generic “Welcome to our product!” email that leads nowhere. Instead, think of it as a strategic drip campaign with clear, actionable next steps.

Here’s a simple, proven sequence that just works:

- Email 1 (Immediately after signup): A warm, personal welcome from the founder or CEO. This email should hammer home your core value proposition and give them one, super-clear call-to-action, like completing their profile.

- Email 2 (Day 2): Shine a spotlight on a single, powerful feature they might have missed. Link them directly to a short video tutorial or a quick-read knowledge base article on how to use it.

- Email 3 (Day 5): Share a customer success story. Find a case study that’s relevant to their business. This gives them social proof and helps them picture what success looks like for them.

- Email 4 (Day 10): Proactively offer help. This is the perfect time to introduce their dedicated Customer Success Manager (CSM) or prompt them to book a one-on-one onboarding call.

Knowing when to offer that personal call is key. For your high-ticket accounts, this should be an automatic, built-in step. For smaller, self-serve customers, you can trigger the offer based on their behavior—for example, if they haven’t activated a key feature after a week.

A classic mistake is burying new users in options. The point of onboarding isn’t to teach them every single thing your product can do. It’s to teach them how to do one thing that solves an immediate pain point.

Shifting from Onboarding to Ongoing Engagement

Onboarding isn’t a one-and-done event. It should flow seamlessly into your ongoing engagement strategy. Once a customer is up and running, your focus has to shift to keeping them active, happy, and constantly aware of the value you’re delivering.

This is where proactive feedback becomes your best friend. Don’t wait for customers to come to you with problems. Use tools like Net Promoter Score (NPS) surveys to regularly take the temperature of your customer base. When a low score comes in, don’t just log it in a spreadsheet. Build a workflow that immediately alerts the CSM to reach out, have a real conversation, and understand the “why” behind that number.

Sharing relevant product updates is another key part of this. When you roll out a new feature, don’t just send a generic email blast to everyone. Segment your list and notify the users who will actually benefit from it the most. It shows you’re paying attention to their needs, not just spamming their inbox. For a deep dive on this, check out our comprehensive customer success playbook.

Finally, empowering users to help themselves is a fantastic, scalable way to improve their experience and lighten your support team’s load. Building a robust knowledge base or a vibrant user community creates a space where customers can find answers 24/7, share tips, and connect with each other. That sense of community builds a stickiness that competitors just can’t replicate.

This intense focus on the customer experience is what drives true loyalty. In fact, research shows that 60% of consumers say quality customer service is the most important factor in their loyalty, and loyal customers end up spending 140% more than those who have had a negative experience. You can discover more insights about these customer retention findings on BloggingWizard.com.

Tailoring Strategies for High-Churn Industries

Let’s get one thing straight: not all churn is created equal. A “good” churn rate in one industry could be a five-alarm fire in another. If you don’t have this context, you’re essentially flying blind. You might be chasing irrelevant benchmarks or, even worse, applying the wrong fixes.

The real key to making progress is to know where your business fits and build your churn reduction playbook from there.

Customer churn rates can swing wildly between sectors. For example, it’s not uncommon for the financial and credit industry to see an average churn rate as high as 25%, while many retail businesses sit around 22%. That’s a world away from digital media and entertainment, where churn is much tighter at about 6%. If you’re curious about the numbers, CustomerGauge publishes the latest findings on average churn rates by industry that are worth checking out.

Knowing these benchmarks helps you set realistic goals. It stops you from panicking over a number that might be perfectly normal for your vertical. Context is everything.

A Playbook for High-Churn SaaS

If you’re operating in a high-churn environment, generic advice just isn’t going to move the needle. You need to be more aggressive, more targeted, and laser-focused on delivering immediate, undeniable value.

Let’s break down what this looks like in two common high-churn SaaS categories.

Retail and E-commerce Tech

This space is notoriously volatile. Your customers likely have low switching costs and are incredibly sensitive to both price and the value they perceive they’re getting.

- Build Proactive Loyalty Programs: Forget simple point systems. You need to tie loyalty directly to product usage. For an e-commerce platform, that could mean offering a small subscription discount after a user processes their 1,000th order.

- Shrink the ‘Time to First Value’: The onboarding for a retail tech user has to be lightning-fast. They need to see a return on their investment—whether that’s a new sale or better efficiency—within days, not weeks. Getting this right is critical. We’ve got some practical advice on this in our guide to SaaS onboarding best practices.

- Shout About Your Differentiators: Your marketing, your success team, and your in-app messaging should constantly reinforce what makes you different. Is it your support? A unique integration? Make sure customers are always reminded why they chose you over a cheaper, easier alternative.

Fintech and Financial Tools

In the fintech world, trust and security are the entire game. Any hint of a weakness can send users running for the exits. The market is also incredibly crowded, so standing out is non-negotiable.

- Over-Communicate on Security: Don’t just slap a “we’re secure” badge on your site. Proactively communicate every security update, certification, and preventative measure you take. This builds a powerful sense of trust and creates a real moat around your product.

- Focus on Market Education: Fintech users want to feel smart and in control. Offer them educational content like webinars on market trends or blog posts that break down complex financial concepts. This simple shift positions you as a trusted advisor, not just another software vendor.

- Offer Usage-Based Incentives: Imagine a tool for financial planning. You could offer a small credit or a free month to users who successfully link all their bank accounts or hit a specific savings goal using your platform. This directly connects your product to their personal success.

In a high-churn sector, your goal isn’t just to make your product sticky; it’s to make it indispensable. Your strategies must be laser-focused on proving your value early and reinforcing it often.

Ultimately, the most effective way to reduce your churn rate is by deeply understanding the unique pressures and expectations of your industry. A retail tech company fighting churn with security updates is wasting its time, just as a fintech tool ignoring educational content is missing a huge opportunity. When you align your retention efforts with the specific DNA of your market, you stop playing defense and start building a resilient business that customers simply don’t want to leave.

Frequently Asked Questions About Reducing Churn

Even with the best playbook in hand, you’re going to hit some bumps and have questions when you start putting a real churn reduction plan into action. That’s completely normal. The key is to anticipate these common hurdles so you can move forward confidently and keep your team on the same page.

I’ve pulled together the questions I hear most often from SaaS operators who are getting serious about tackling churn. My goal is to give you straightforward, no-fluff answers to help you stay focused on what really moves the needle.

What’s a “Good” Churn Rate to Aim For?

This is always the first question, and the honest answer is… it depends. While it can vary wildly depending on your industry and who you sell to (SMB vs. Enterprise), a solid annual churn rate for most SaaS companies to shoot for is between 5-7%.

But don’t get too hung up on that number. The real goal isn’t to hit some magic benchmark someone else set. It’s about making steady, consistent progress.

If you can lower your current churn rate month after month, you’re winning. That’s the hallmark of a healthy business that listens to its customers and adapts.

How Soon Should I Expect to See Results?

You’ll see movement in your leading indicators pretty quickly. Things like customer engagement, how often new features are being used, or your customer health scores can start to tick up within 30-60 days of launching a new initiative, like a revamped onboarding flow.

Seeing a real drop in your bottom-line churn rate, however, takes more time. You’re looking at closer to 3-6 months before you can see a measurable dip. Why? Because you have to wait for at-risk customers to go through their current billing cycle. So, be patient and trust the process.

The trick is to watch both leading and lagging indicators. Better engagement today directly leads to lower churn tomorrow. Don’t lose faith if the final number doesn’t budge right away.

Should I Offer Discounts to Customers Who Threaten to Cancel?

It’s tempting to throw a discount at a customer heading for the exit. It feels like an easy save, but it’s a short-term band-aid that can cause long-term problems. You risk devaluing your product and, worse, teaching customers that all they have to do is threaten to leave to get a better deal.

Instead, treat that cancellation request as a golden opportunity to learn. This is your last chance to truly understand why they’re unhappy.

- Is the product missing something critical for them?

- Did they have a terrible onboarding experience?

- Was their support ticket handled poorly?

Focus on solving the root problem first. A discount can be part of your toolkit, but it should be a last resort, not your go-to move. For a deeper dive, check out our guide on customer retention in SaaS.

Don’t underestimate the power of direct communication here. It’s telling that 89% of companies still use email as their main channel for retention-focused outreach, as highlighted in some recent customer retention stats from BloggingWizard. Having a personal, efficient way to connect with users on the fence is absolutely essential.

By digging into the “why” behind every cancellation request, you not only stand a better chance of saving that customer but also uncover insights that will help you prevent more churn down the road.

At SaaS Operations, we provide battle-tested playbooks and templates that help you implement these churn-reduction frameworks efficiently. Stop guessing and start building a more resilient business today. Get started with our proven SOPs.

Swipe & Deploy Playbooks

Stop running in mud and get your team ahead today. Discover actionable playbooks you can use instantly.

Create Playbooks- ✓ Step-by-step guides

- ✓ Proven templates

- ✓ Team checklists